Beyond the Skyline: Why the Dubai Real Estate Market Remains a Global Hotspot

If you look at the Dubai skyline, you see more than just steel and glass; you see ambition. For years, critics whispered that the property bubble was bound to burst. Yet, year after year, the emirate defies expectations. It has evolved from a speculative playground into one of the most robust, mature, and sought-after sectors in the global economy: the Dubai real estate market.

Whether you are an expat looking for a luxury home or an international investor seeking high yields, the current landscape offers a narrative of stability and unmatched opportunity. Here is why the world is still flocking to the UAE, and what you need to know about buying property in Dubai right now.

1. The "Safe Haven" Effect: Stability in Uncertain Times

In an era of global geopolitical instability and economic uncertainty, Dubai has positioned itself as a neutral, safe harbor. The government’s proactive handling of the post-pandemic economy, combined with world-class safety ratings, has attracted massive inflows of High-Net-Worth Individuals (HNWIs) from Europe, Asia, and the Americas.

The Shift to Residency: People aren’t just buying houses here to flip them anymore; they are buying homes to live in. This shift from a "transient" population to a "resident" population has fundamentally strengthened the floor of the Dubai real estate market, reducing volatility and increasing long-term value.

2. The Numbers: High ROI and Tax Benefits

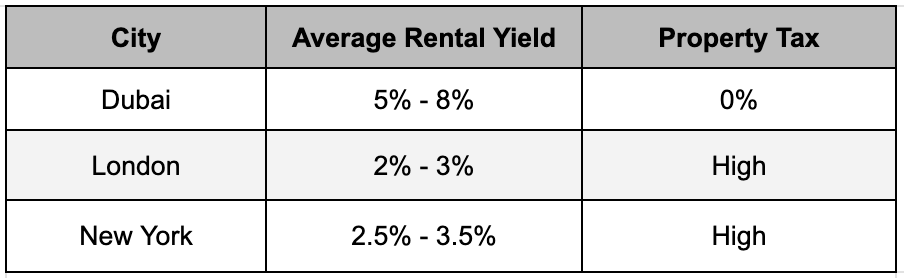

Let’s talk business. When compared to global hubs like London, New York, or Hong Kong, Dubai property prices remain undervalued on a price-per-square-foot basis. However, the real draw for investors is the return on investment (ROI).

- High Rental Yields: Investors in Dubai often enjoy gross rental yields of 5% to 8%, significantly higher than the 2-3% averages seen in major European capitals.

- Tax Efficiency: The absence of property tax and capital gains tax remains the crown jewel of Dubai’s investment appeal. While corporate tax has been introduced in the UAE, personal income and residential real estate investments generally remain outside this net.

3. The Golden Visa: A Game-Changer for Expats

Perhaps the single biggest driver of the recent boom is the UAE Golden Visa. Previously, residency was tied strictly to employment, creating a sense of impermanence.

Now, investing AED 2 million (approx. $545,000) in real estate grants investors a 10-year renewable residency. This initiative has provided a massive psychological safety net for expatriates, encouraging them to put down roots and buy larger, long-term family homes in communities like Dubai Hills Estate or Arabian Ranches rather than renting temporary apartments.

4. 2025 Trends: Branded Residences & Off-Plan Projects

Two distinct trends are dominating the headlines for the Dubai real estate market in 2024 and 2025:

- The Rise of Branded Residences: Dubai is now the global capital for branded homes. From Bugatti Residences to Armani and Four Seasons, developers are partnering with luxury brands to offer ultra-exclusive lifestyle experiences that command premium resale values.

- The Off-Plan Market: Developers are launching projects at a breakneck pace. The appeal of off-plan properties in Dubai is the payment plan—often allowing buyers to pay 50-60% of the value over the construction period, paying the balance only upon handover.

s It Too Late to Buy Property in Dubai?

This is the most common question we hear. While the "bargain basement" prices of 2020 are gone, the market has shifted from recovery to sustainable growth.

Experts suggest that while steep vertical price hikes may level off, the demand for prime waterfront property (like Palm Jumeirah) and established villa communities continues to outstrip supply. The market is not just growing; it is maturing.

The Verdict

The Dubai real estate market is no longer just about the tallest tower or the biggest mall. It is about a lifestyle that is becoming increasingly difficult to find elsewhere: safe, tax-efficient, sunny, and cosmopolitan.

Whether you are looking for a high-yield studio in Business Bay or a luxury villa on the Palm, the window of opportunity is open—but the competition is waking up.